There is a large number of currency trading designs that may be put on the FX market. Specific traders leave their positions available for months, although some can open and close their roles in an interval of minutes. This article focuses on the second group of the currency trading styles.

Day Trading: Forex Trading Styles

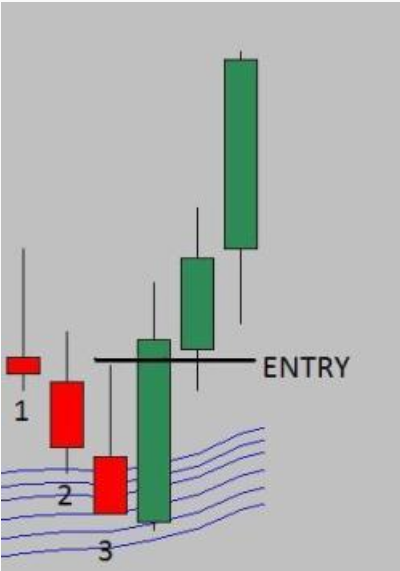

forex trading styles It relates to currency trading designs that consist in trading within the length of 1 day, without making jobs available overnight. With this

forex trading style traders wish they register a tiny profit in each trade. The earnings can mount up on the span of the afternoon leaving the trader in outstanding

financial situation.Due to the reality that no positions are left available, the investor can relax through the evening, without having to concern yourself with the purchase price motions. They also don’t have to worry about rollover fees which are increasingly typical and used by a large quantity of agents. Considering that the place is closed during the end of the afternoon, rollover charges don’t have actually to be paid.

It is critical to have a plan that is well set up, because stock investing requires taking choices in a really short interval of time and traders need to resist to the strain than can build up during this time period. Additionally it's possible for new traders to help make mistakes, such as starting many trades regardless if a lot of them are maybe not justified by indicators and there's perhaps not enough reasoning to help them. The may also succumb to stress and not make trades with a clear head and relaxed attitude. This might be among the greatest currency trading styles, yet it has its risks.

This plan requires a trader that is really active and that will just take the mandatory choices while having a clear reasoning in it.

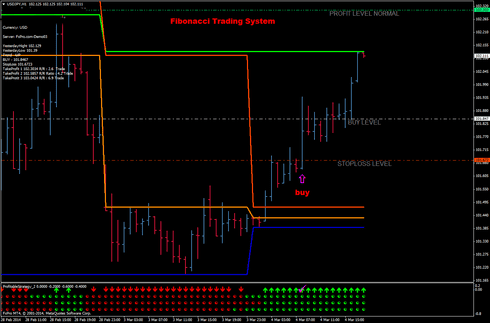

Forex Trading Style – Scalping

It really is a single for the forex trading styles that has gained traction within the last few amount of time and that has caused individuals to speak about it, both in a good and negative way. It consists in making profit through the distinctions of the bid/ask spread in the marketplace.

The traders that apply the scalping strategy act like market manufacturers. Making the spread means buying during the bid price, the tiniest price, and attempting to sell at the ask price, the greatest cost. This enables them to help make profit no matter if the bid and have don’t modify their value throughout the day. Using revenue in this manner calls for only traders who're ready to trade at market rates. The role of the scalper is identical to the part of this market maker, which will be making sure there is sufficient supply of cash to enable the instructions become processed smoothly.

Up to now this has been said that the spread is a cost that the investor must spend and his earnings must surpass this price in purchase to appreciate revenue. Now it is said that the spread may also be earned. So that you can explain this situation it is essential to make a distinction. The ask costs are the rates at that your requests could be performed straight away for fast buyers. The bid costs are the prices of which sales could be executed immediately for fast sellers. If we simply take fast out associated with the equation, it really is easy to understand that traders who wish to possess their order queued will get the spreads. Traders that do not want to possess their purchase queued will spend the spread. For these forex trading styles, the spread can be the primary, if maybe not only, supply of profit.

The advantage that scalpers have over regular traders is the fact that they could gain from small movements of cost at any given time. These small motions have actually a bigger probability to take place, in comparison to big cost movements. When there will be lots of buyers, the costs will rise and the traders with a lengthy position will profit. When there are a great number of sellers, the prices will fall therefore the traders with a short place will profit. If you find neither a worthwhile level of purchasers or sellers that is whenever industry makers revenue. It’s true that the market manufacturers profit in most case, but in case the price doesn’t move, it's more straightforward to see the distinction between them and other market participants, simply because they are the only person who profit for the reason that amount of time.

Scalpers open and close a situation in a really brief period of time, such as for example moments or moments. This permits them to start a very many jobs through the day which could assist them register profits. They can register a huge selection of tiny earnings aswell as a huge selection of little losings and additionally they have to have good danger administration concepts so as to handle their roles.

To allow the small pip movement to express a rewarding revenue, the amount of trading is correspondingly huge. A lot of capital is needed to be able to gain from such forex trading designs. This is just why

1000ea.blogspot.com recommends you to take a good look at the most useful

STP Brokers, as scalping is mostly lucrative with them.

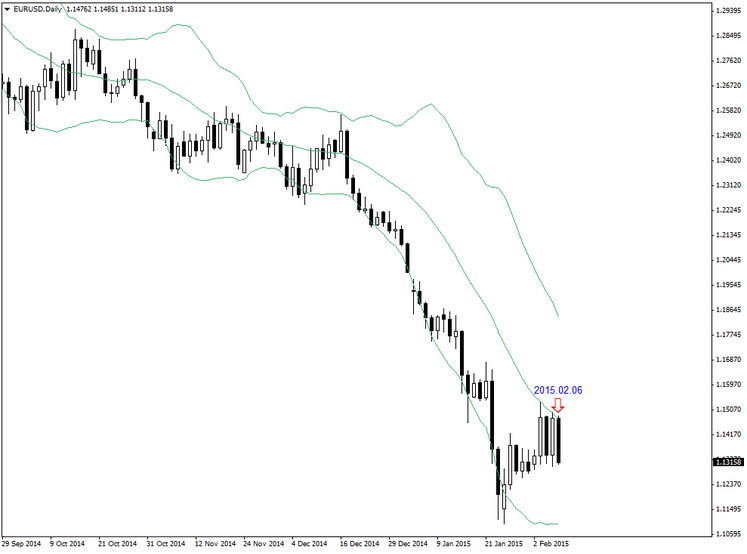

News Releases Forex Trading Styles

People enjoy dealing whenever there is of volatility within the market as it is the best opportunity to make a revenue. Additionally they take advantage of news releases to be able to now by which direction they need to take a situation. If indicators such as Gross Domestic Product or Retail product sales are increasingly being broadcast to be unique of what industry expects, then this can cause price motions into the market.

One technique is for an investor to enter industry with a hedged place. What this means is that he can purchase a currency pair with one market purchase and offer it with a different one. The most interesting forex currency trading styles!

As soon as a news launch breaks away, the price is thought to move in a way. Now the trader has got the possiblity to close a position by registering make money from it. Whenever the market relapses

therefore the price moves in the opposite way, the trader can close his remaining purchase getting no profit or a reduced one. Overall, the investor gained through the order shut first.

The drawback of such forex trading styles is that the trader has to cover two spreads, however it has the bonus of letting him get big earnings if the marketplace is dynamic sufficient to let him work in accordance with this particular principle.