Trend and channel lines:

Finally let's appearance at some typical trend lines and habits they mean that you might look out for in the actual globe and what.

Firstly, to put down the terms that are technical. A trend line connects two or more prices and anticipating the extension of cost movement into the long term. Whenever a price breaks through a trend line this might indicate a change that is possible the trend.

You will find two kinds of trend line: upward, which connects a couple of significant bottom points in an upward trend; and a downward trend line which links two significant top points in a style that is downward.

Technicians believe the longer the trend, the more reliable it really is therefore the longer the time-frame employed for the chart, the more significant the trend line is. More over, a trend that is broken becomes a support.

Trenches --often, when movement that is drawing technicians find 'trench lines' or 'channels', though trench lines are never as significant as the trend line – if a trench line is broken this isn't usually indicative of anything unlike the breaking of a trend line.

Trend reversal / continuation patterns and flags:

a pattern is a grouping that is significant of on a chart. These patterns, which evolve slowly in the long run, would be the key runes that chartists look over to predict price that is future.

It really is generally thought that the more expensive the pattern, the greater amount of significant the move which follows it.

Some trend reversal patterns:

Head & Shoulder pattern:

A head & neck pattern (low cost) shows the beginning of greater prices, provided the throat line is broken through, it would seem like this:

a mind & neck pattern (high cost) suggests the commencement of lower prices, provided the neck line is broken through, it might look similar to this:

DOUBLE BOTTOM:

DOUBLE TOP:

TRIPLE BOTTOM:

Best Forex Tools Provides its users the best Forex trading tips, strategies, indicators, auto trading robots or ea, and best forex systems based on best indicators with alert.

Showing posts with label Technical Analysis. Show all posts

Showing posts with label Technical Analysis. Show all posts

Wednesday, 11 February 2015

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 8)

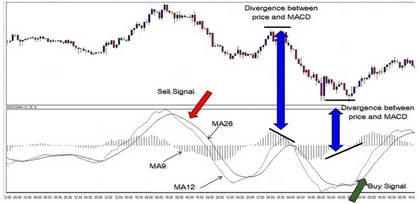

– Moving Average Convergence-Divergence that is (MACD) is an indicator also predicated on going averages. It's composed of two lines: the very first (bold) line (see chart from Sunbird FX below) is certainly the distinction between two averages which are moving. The MACD is just actually effective in a market showing a trend, and ineffective in an industry that is sideways.

Whenever the MACD lies higher than its 9-day exponential average that is moving technical analysts will consider energy to be bullish, or regarding the up. As soon as the MACD line breaks the sign line upwards, this comprises a confident sign, plus it shows a hold in the currency while it remains above the oscillator line. Once the sign is crossed by the MACD line line downwards, this represents an adverse or a sell signal.

A reversal from a poor value to a confident value is a buy signal, and the reverse - a sell signal with the MACD indicator.

STOCHASTICS:

The price tends to shut near its daily high, with strong buyer stress, while in downward trends, rates have a tendency to shut near their low, with strong vendor stress as a technical indicator, stochastics oscillators are based on the assumption that in an upward trend. Simply put, stochastics are employed to gauge whether a market is oversold or overbought. Above 80 in the oscillator is generally considered overbought and below 20 is known as oversold.

Stochastics oscillators are employed consequently to get the general position for the cost that is near the low while the high.

In other words, when the stochastic is below the 20 line that is oversold the %K line crosses over the %D line, buy. And as soon as the Stochastic is over the 80 line that is overbought the %K line crosses underneath the %D line, sell.

Like other tools that are technical they aren't stand-alones and really should be considered to be another tool, in addition towards the many technical tools which we utilize.

NEXT PAGE

Whenever the MACD lies higher than its 9-day exponential average that is moving technical analysts will consider energy to be bullish, or regarding the up. As soon as the MACD line breaks the sign line upwards, this comprises a confident sign, plus it shows a hold in the currency while it remains above the oscillator line. Once the sign is crossed by the MACD line line downwards, this represents an adverse or a sell signal.

A reversal from a poor value to a confident value is a buy signal, and the reverse - a sell signal with the MACD indicator.

STOCHASTICS:

The price tends to shut near its daily high, with strong buyer stress, while in downward trends, rates have a tendency to shut near their low, with strong vendor stress as a technical indicator, stochastics oscillators are based on the assumption that in an upward trend. Simply put, stochastics are employed to gauge whether a market is oversold or overbought. Above 80 in the oscillator is generally considered overbought and below 20 is known as oversold.

Stochastics oscillators are employed consequently to get the general position for the cost that is near the low while the high.

In other words, when the stochastic is below the 20 line that is oversold the %K line crosses over the %D line, buy. And as soon as the Stochastic is over the 80 line that is overbought the %K line crosses underneath the %D line, sell.

Like other tools that are technical they aren't stand-alones and really should be considered to be another tool, in addition towards the many technical tools which we utilize.

NEXT PAGE

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 7)

TREND-FOLLOWING INDICATORS:

Trend-following indicators are utilized to determine the trend that is prevailing to find entry or exit points for a trade. They consist of going averages, oscillators, Bollinger bands, convergence and divergence, and moving convergence-divergence that is averageMACD).

– Moving averages (MA) are extremely popular and most likely the simplest to implement in fundamental analysis that is technical but will also be crucial elements of more complex technical indicators and techniques. They is accessed on many simple charts on monetary websites and search in the chart that is real. Simple moving averages (SMAs) are an easy MA derived by calculating the typical price over a pre-defined time frame, such as 50 times or 200 days, so that they lessen the cost information to make a trend-following indicator, this means rather than predicting price way, they assist define the way that is current.

The analysis that is technical methods frequently utilized are predicated on when 2 or 3 MAs cross or whenever the cost crosses a MA. The way of the average that is moving significant price information: a rising MA indicates costs are generally increasing while a falling MA signifies prices, an average of, are dropping. An increasing long-term MA reflects a long-term up-trend, while a falling one reflects a down-trend that is long-term. Professionals will inform you that is very important to see the price distance from the averages and the distance involving the averages suggest extreme amounts, a trend that is weakening the begin of modification.

– Oscillators are indicators for over-bought or situations which can be over-sold. Traders employ oscillators to greatly help with pinpointing possibly the way of future prices and to look for variance (deviations) involving the oscillator and the cost. They are mostly useful in market that is laterally and can include MACD (see below).

– Bollinger bands can be accessed on many charts being simple financial websites enable traders to compare volatility and cost degree. This indicator that is technical composed of three bands: the center band is in fact a simple moving average; the upper is the chosen moving average plus a specified quantity of standard deviations centered on volatility; while the reduced may be the selected moving average minus the specified quantity of standard deviations.

Volatility, shown by razor-sharp moves either upward or downward in the deviations, would result in the bands to expand, therefore showing volatility that is increased. The conventional deviations measure just how far the close price levels come from the cost that is average. The larger the difference between the degree that is close the common, the bigger the typical deviation and volatility.

Technical analysts watch out for the exact distance between bands - are they near together or far aside? Price convergence will come before a break-out, or will they be oriented upward or downward, or will they be balanced?

– The Relative Strength Index (RSI) is an indicator is shown in a screen that is separateas shown in the chart below) and is divided into 30-70 amounts. This is amongst the most indicators that are dependable in technical analysis; it steps cost levels vs. buyer and seller resilience. If the indicator is below 30, there is seller stress because of this currency, of course the RSI is above 70, there was customer pressure for this currency.

Technical analysts watch out for motions above 55 – which are a good trend, while below 45 is a trend that is negative. Readings below 30 point out over-selling, while readings above 70 designate over-buying. At these amounts traders might expect the marketplace to fix – it's usually a sign for a reversal of the trend that is short-term.

NEXT PAGE

Trend-following indicators are utilized to determine the trend that is prevailing to find entry or exit points for a trade. They consist of going averages, oscillators, Bollinger bands, convergence and divergence, and moving convergence-divergence that is averageMACD).

– Moving averages (MA) are extremely popular and most likely the simplest to implement in fundamental analysis that is technical but will also be crucial elements of more complex technical indicators and techniques. They is accessed on many simple charts on monetary websites and search in the chart that is real. Simple moving averages (SMAs) are an easy MA derived by calculating the typical price over a pre-defined time frame, such as 50 times or 200 days, so that they lessen the cost information to make a trend-following indicator, this means rather than predicting price way, they assist define the way that is current.

The analysis that is technical methods frequently utilized are predicated on when 2 or 3 MAs cross or whenever the cost crosses a MA. The way of the average that is moving significant price information: a rising MA indicates costs are generally increasing while a falling MA signifies prices, an average of, are dropping. An increasing long-term MA reflects a long-term up-trend, while a falling one reflects a down-trend that is long-term. Professionals will inform you that is very important to see the price distance from the averages and the distance involving the averages suggest extreme amounts, a trend that is weakening the begin of modification.

– Oscillators are indicators for over-bought or situations which can be over-sold. Traders employ oscillators to greatly help with pinpointing possibly the way of future prices and to look for variance (deviations) involving the oscillator and the cost. They are mostly useful in market that is laterally and can include MACD (see below).

– Bollinger bands can be accessed on many charts being simple financial websites enable traders to compare volatility and cost degree. This indicator that is technical composed of three bands: the center band is in fact a simple moving average; the upper is the chosen moving average plus a specified quantity of standard deviations centered on volatility; while the reduced may be the selected moving average minus the specified quantity of standard deviations.

Volatility, shown by razor-sharp moves either upward or downward in the deviations, would result in the bands to expand, therefore showing volatility that is increased. The conventional deviations measure just how far the close price levels come from the cost that is average. The larger the difference between the degree that is close the common, the bigger the typical deviation and volatility.

Technical analysts watch out for the exact distance between bands - are they near together or far aside? Price convergence will come before a break-out, or will they be oriented upward or downward, or will they be balanced?

– The Relative Strength Index (RSI) is an indicator is shown in a screen that is separateas shown in the chart below) and is divided into 30-70 amounts. This is amongst the most indicators that are dependable in technical analysis; it steps cost levels vs. buyer and seller resilience. If the indicator is below 30, there is seller stress because of this currency, of course the RSI is above 70, there was customer pressure for this currency.

Technical analysts watch out for motions above 55 – which are a good trend, while below 45 is a trend that is negative. Readings below 30 point out over-selling, while readings above 70 designate over-buying. At these amounts traders might expect the marketplace to fix – it's usually a sign for a reversal of the trend that is short-term.

NEXT PAGE

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 6)

FIBONACCI THEORY:

Leonardo Fibonacci was a mathematician living in Italy in the ages that are center introduced to the western a series of figures that first was described in India some hundreds of years before and normally thought to match unique ratios that occur to also take place in nature. Fibonacci is believed to be 1st to create ratios or solutions for quadratic equations, and was among the europeans that are first write about algebra. Using Fibonacci lines for technical trading and analysis is generally done in combination with Elliott waves.

The amount series after which it he could be most widely known, called the Fibonacci Series, begins with 0 then 1 and then each element that is subsequent this show is the sum the 2 elements preceding it:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, 10946, 17711 so on.

Additionally, and maybe crucially, each true quantity is roughly 1.61 times bigger than its preceding number. This is named the Golden Ratio.

Employing the Fibonacci ratio for trading:

Fibonacci numbers are used for technical analysis in forex and lots of other kinds of trading since they are believed to help anticipate changes in trends because prices in many cases are discovered to flex at points near lines linked to the Fib series. The argument often utilized by Fibonacci supporters is that because the ratio that is golden in nature additionally the stock market and money markets are creations of nature – people – that the Fibonacci sequence should connect with the financial markets. Fibonacci-based tools employed by traders include Fibonacci retracements, Fibonacci arcs and Fibonacci fans.

Fibonacci retracement levels – that are used as help and resistance levels – are said to be at 0.382, 0.500 (even though this has absolutely nothing to do with the mathematician that is italian simply fits the idea) and 0.618. Begin to see the chart.

Fibonacci extension levels, that are utilized as revenue amounts that are taking are 0.618, 1.000, 1.618.

Fibonacci ratios occur in ratios between correction movement waves together with trend that is main and nearly all technical modifications during trading are 38.2% of the newest enhance (which could be the complementary number to 61.8%).

TECHNICAL CORRECTIONS:

A technical modification is a counter-trend motion which wipes out 38%-61% regarding the preceding motion; the reasons behind this are profit taking, support and opposition lines, published data etc that is economic. Fibonacci lines with this motion are drawn from the purchase price that is cheapest to the greatest price in the chart. There are not any price movements without a correction that is technical whatever the time interval. Back into the most truly effective

A Fibonacci retracement here:

A Fibonacci retracement extension here:

What are technical indicators?

Technical indicators are additional tools that form section of a chart, being derived mathematically from market prices, but are not absolute, and cannot anticipate costs that are future. They connect with a string of values based on the price show during trading, that are obtained by placing information in a formula. They are used to give alerts, confirmations which help in forecasting price fluctuations. Indicators are categorized into two groups: trend-following indicators and stochastics.

NEXT PAGE

Leonardo Fibonacci was a mathematician living in Italy in the ages that are center introduced to the western a series of figures that first was described in India some hundreds of years before and normally thought to match unique ratios that occur to also take place in nature. Fibonacci is believed to be 1st to create ratios or solutions for quadratic equations, and was among the europeans that are first write about algebra. Using Fibonacci lines for technical trading and analysis is generally done in combination with Elliott waves.

The amount series after which it he could be most widely known, called the Fibonacci Series, begins with 0 then 1 and then each element that is subsequent this show is the sum the 2 elements preceding it:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, 10946, 17711 so on.

Additionally, and maybe crucially, each true quantity is roughly 1.61 times bigger than its preceding number. This is named the Golden Ratio.

Employing the Fibonacci ratio for trading:

Fibonacci numbers are used for technical analysis in forex and lots of other kinds of trading since they are believed to help anticipate changes in trends because prices in many cases are discovered to flex at points near lines linked to the Fib series. The argument often utilized by Fibonacci supporters is that because the ratio that is golden in nature additionally the stock market and money markets are creations of nature – people – that the Fibonacci sequence should connect with the financial markets. Fibonacci-based tools employed by traders include Fibonacci retracements, Fibonacci arcs and Fibonacci fans.

Fibonacci retracement levels – that are used as help and resistance levels – are said to be at 0.382, 0.500 (even though this has absolutely nothing to do with the mathematician that is italian simply fits the idea) and 0.618. Begin to see the chart.

Fibonacci extension levels, that are utilized as revenue amounts that are taking are 0.618, 1.000, 1.618.

Fibonacci ratios occur in ratios between correction movement waves together with trend that is main and nearly all technical modifications during trading are 38.2% of the newest enhance (which could be the complementary number to 61.8%).

TECHNICAL CORRECTIONS:

A technical modification is a counter-trend motion which wipes out 38%-61% regarding the preceding motion; the reasons behind this are profit taking, support and opposition lines, published data etc that is economic. Fibonacci lines with this motion are drawn from the purchase price that is cheapest to the greatest price in the chart. There are not any price movements without a correction that is technical whatever the time interval. Back into the most truly effective

A Fibonacci retracement here:

A Fibonacci retracement extension here:

What are technical indicators?

Technical indicators are additional tools that form section of a chart, being derived mathematically from market prices, but are not absolute, and cannot anticipate costs that are future. They connect with a string of values based on the price show during trading, that are obtained by placing information in a formula. They are used to give alerts, confirmations which help in forecasting price fluctuations. Indicators are categorized into two groups: trend-following indicators and stochastics.

NEXT PAGE

Tuesday, 10 February 2015

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 5)

Accountant Ralph Nelson Elliott (1871-1948) developed a theory in the 1930s where he claimed that market prices evolve in well defined habits. Market specialists now call these trading habits Elliott Waves.

Elliott claimed that market movement was based on audience therapy of booms and busts, rallies and retracements being mathematical which led to patterns that worked as follows (see charts too):

1. Five waves in the way of the style that is primary1,2,3,4,5).

2. Three waves into the correction trend (a,b,c). ).

3. Elliott identified the recurring pattern of market movements: five waves pushing in the trend direction, and three modification waves counter that is acting the trend direction.

4. an trend that is upward of five upward waves and three downward waves.

5. a trend that is downward of five downward waves and three upward waves.

Elliott revolution concept is an as a type of technical analysis, employed by investors to forecast trends in money markets, with all the waves used to evaluate the probability of areas moving in a direction that is particular within trends. The concept helps traders find the price that is proper and entry timing for a trading strategy.

The guidelines that are fundamental revolution concept are (see chart above) that Wave 2 may maybe not break through Wave 1; that Wave 3 may possibly not be the quickest of waves 1,3,5; that Wave 4 may perhaps not encroach on Wave 1 territory; and that Wave 2 and revolution 4 are going to be in various patterns (revolution shape and size)

NEXT PAGE

Elliott claimed that market movement was based on audience therapy of booms and busts, rallies and retracements being mathematical which led to patterns that worked as follows (see charts too):

1. Five waves in the way of the style that is primary1,2,3,4,5).

2. Three waves into the correction trend (a,b,c). ).

3. Elliott identified the recurring pattern of market movements: five waves pushing in the trend direction, and three modification waves counter that is acting the trend direction.

4. an trend that is upward of five upward waves and three downward waves.

5. a trend that is downward of five downward waves and three upward waves.

Elliott revolution concept is an as a type of technical analysis, employed by investors to forecast trends in money markets, with all the waves used to evaluate the probability of areas moving in a direction that is particular within trends. The concept helps traders find the price that is proper and entry timing for a trading strategy.

The guidelines that are fundamental revolution concept are (see chart above) that Wave 2 may maybe not break through Wave 1; that Wave 3 may possibly not be the quickest of waves 1,3,5; that Wave 4 may perhaps not encroach on Wave 1 territory; and that Wave 2 and revolution 4 are going to be in various patterns (revolution shape and size)

NEXT PAGE

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 4)

SIGNIFICANT CANDLESTICK PATTERNS:

When a technical analyst talks about reversals, they are generally referring more to long-term formations, with common reversal patterns (see below) including 'double top', 'head and shoulders' and 'hanging man & hammer'.

The hanging man and hammer patterns are made up of a (bullish or bearish) candlestick with a long lower shadow and a human anatomy that is narrow. The reduced shadow must be at the very least twice the dimensions for the body (for a stronger signal) with this pattern.

The reversal candlestick must certanly be located during the end of an trend that is upwardthe Hanging Man) or at the end of a downward trend (the Hammer). Click right here for an illustration of a hammer signalling the reversal of a trend that is bearish an upturn.

DOJI REVERSAL PATTERNS :

A candlestick where the available and close prices are exactly the same or nearly the same (the + or dash mentioned above) is considered a pattern in its own– that is correct called a Doji pattern. Obviously since the candlestick does not have any body this suggests a trading range that is narrow.

Doji are created whenever opening and closing prices are nearly the– that is exact same although the size of wick and end may differ. While doji are neutral patterns on their particular, any bullish or bearish implications are obtained from preceding cost action and verification that is future. It is said that Doji convey an awareness of tense tug-of-war or indecision between buyers and vendors. Prices vacillate throughout the session, but near at a standoff. Neither bulls nor bears could actually gain control and a turning point might be developing. Candlestick guru Steve Nison maintains that doji showing up among other candlesticks with tiny bodies that are real less significant, while doji that form among longer candlesticks is significant.

A classic doji, where the two shadows are of equal length rather than particularly long is believed to often precede a cost style that is essential.

SUPPORT AND RESISTANCE LEVELS:

Support and opposition levels are a essential part of technical analysis, and can be reasonably easily found by analysing cost that is fundamental.

Help means the particular level or point on the chart where buyer pressure, or need for the protection, is strong enough to avoid any decline that is further cost.

This arises because as price approaches this area, the reduced pricing is more appealing for buyers, leading to demand that is extra supply at this level, thereby preventing prices from decreasing below the help level.

Technical analysts constantly suppose that when a support level is breached, a fresh, lower support level is created below, however.

Likewise, resistance is understood to be the amount regarding the chart where vendor stress is strong sufficient to stop any cost that is further. And as with support, when the resistance degree is breached, a new, higher resistance degree will probably be created.

NEXT PAGE

When a technical analyst talks about reversals, they are generally referring more to long-term formations, with common reversal patterns (see below) including 'double top', 'head and shoulders' and 'hanging man & hammer'.

The hanging man and hammer patterns are made up of a (bullish or bearish) candlestick with a long lower shadow and a human anatomy that is narrow. The reduced shadow must be at the very least twice the dimensions for the body (for a stronger signal) with this pattern.

The reversal candlestick must certanly be located during the end of an trend that is upwardthe Hanging Man) or at the end of a downward trend (the Hammer). Click right here for an illustration of a hammer signalling the reversal of a trend that is bearish an upturn.

DOJI REVERSAL PATTERNS :

A candlestick where the available and close prices are exactly the same or nearly the same (the + or dash mentioned above) is considered a pattern in its own– that is correct called a Doji pattern. Obviously since the candlestick does not have any body this suggests a trading range that is narrow.

Doji are created whenever opening and closing prices are nearly the– that is exact same although the size of wick and end may differ. While doji are neutral patterns on their particular, any bullish or bearish implications are obtained from preceding cost action and verification that is future. It is said that Doji convey an awareness of tense tug-of-war or indecision between buyers and vendors. Prices vacillate throughout the session, but near at a standoff. Neither bulls nor bears could actually gain control and a turning point might be developing. Candlestick guru Steve Nison maintains that doji showing up among other candlesticks with tiny bodies that are real less significant, while doji that form among longer candlesticks is significant.

A classic doji, where the two shadows are of equal length rather than particularly long is believed to often precede a cost style that is essential.

SUPPORT AND RESISTANCE LEVELS:

Support and opposition levels are a essential part of technical analysis, and can be reasonably easily found by analysing cost that is fundamental.

Help means the particular level or point on the chart where buyer pressure, or need for the protection, is strong enough to avoid any decline that is further cost.

This arises because as price approaches this area, the reduced pricing is more appealing for buyers, leading to demand that is extra supply at this level, thereby preventing prices from decreasing below the help level.

Technical analysts constantly suppose that when a support level is breached, a fresh, lower support level is created below, however.

Likewise, resistance is understood to be the amount regarding the chart where vendor stress is strong sufficient to stop any cost that is further. And as with support, when the resistance degree is breached, a new, higher resistance degree will probably be created.

NEXT PAGE

Technicle Analysis For Forex Traders - JAPANESE CANDLESTICKS (Part 3)

JAPANESE CANDLESTICKS:

The candlestick that is japanese was developed hundreds of years ago by Japanese rice farmers, apparently. Also known just as candlestick charts, these graphs display the price in the shape of a candlestick, with open/close/high/low all included and different tints generally speaking utilized for rising and dropping markets over a period that's sure, be that a moment, hour, time, week or thirty days.

A green, white or candlestick that is blue usually used for a rising candlestick, in which the closing pricing is more than the opening price. Habitually a red or black block represents a declining candlestick, utilizing the close price less than the price that is available. The 'wick' or 'shadow' sticking away from the top the candle represents the cost that is high that candle's time-frame, while the shadow or 'tail' protruding through the bottom corresponds to the low cost during the time-frame.

A cross (+), or a dash (-), it indicates the opening and closing cost was similar during that candle’s time-period and it is often considered a pattern of its very own (see Doji below) in the event that candle has no 'wax', or real body, and looks like a capital " T".

Some great benefits of the candlestick chart over line or club maps are that candlestick maps allow you to swiftly spot cost trends simply by watching along with in order to easily see just what the stock did during the best time frame. And crucially, candlesticks permit you to more easily spot reversals. Reversals are short-term alterations in price direction that are exactly the type of movement that swing traders look out for.

NEXT PAGE

The candlestick that is japanese was developed hundreds of years ago by Japanese rice farmers, apparently. Also known just as candlestick charts, these graphs display the price in the shape of a candlestick, with open/close/high/low all included and different tints generally speaking utilized for rising and dropping markets over a period that's sure, be that a moment, hour, time, week or thirty days.

A green, white or candlestick that is blue usually used for a rising candlestick, in which the closing pricing is more than the opening price. Habitually a red or black block represents a declining candlestick, utilizing the close price less than the price that is available. The 'wick' or 'shadow' sticking away from the top the candle represents the cost that is high that candle's time-frame, while the shadow or 'tail' protruding through the bottom corresponds to the low cost during the time-frame.

A cross (+), or a dash (-), it indicates the opening and closing cost was similar during that candle’s time-period and it is often considered a pattern of its very own (see Doji below) in the event that candle has no 'wax', or real body, and looks like a capital " T".

Some great benefits of the candlestick chart over line or club maps are that candlestick maps allow you to swiftly spot cost trends simply by watching along with in order to easily see just what the stock did during the best time frame. And crucially, candlesticks permit you to more easily spot reversals. Reversals are short-term alterations in price direction that are exactly the type of movement that swing traders look out for.

NEXT PAGE

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 2)

Technical analysis techniques:

Listed below are several examples of different factors and themes of technical analysis, from forms of chart and graphical that is significantly diffent you are able to utilize, right through to kinds of trend and patterns and that means you know things to look for.

Line Charts: A line chart is considered the most easy chart, based on closing prices over a period of time that is stated. The chart's vertical axis represents the purchase price (or trade price in forex) therefore the horizontal axis represents the time scale for total, absolute newby beginners. Costs are plotted from left to right, aided by the present price consequently being the over in the hand side that is appropriate.

The assumption of the chart is that the most price that is essential the closing cost. This is an instant indicator, best for pattern identification and is perhaps best suited to trading that is long-lasting.

BAR CHARTS - OHLC:

Price club charts suggest for each selected timeframe the high, low, open and rates which are close or Open High, Low Close (OHLC). The high and low costs are shown in the bar respectively: the cost that is open the short horizontal line to the left and the close price – to the right. The benefit that is major this graphical presentation is the indicator not just of prices, but also associated with the trading range for the given time framework. Somewhat comparable to candlestick maps, see below.

Next Page

Listed below are several examples of different factors and themes of technical analysis, from forms of chart and graphical that is significantly diffent you are able to utilize, right through to kinds of trend and patterns and that means you know things to look for.

Line Charts: A line chart is considered the most easy chart, based on closing prices over a period of time that is stated. The chart's vertical axis represents the purchase price (or trade price in forex) therefore the horizontal axis represents the time scale for total, absolute newby beginners. Costs are plotted from left to right, aided by the present price consequently being the over in the hand side that is appropriate.

The assumption of the chart is that the most price that is essential the closing cost. This is an instant indicator, best for pattern identification and is perhaps best suited to trading that is long-lasting.

BAR CHARTS - OHLC:

Price club charts suggest for each selected timeframe the high, low, open and rates which are close or Open High, Low Close (OHLC). The high and low costs are shown in the bar respectively: the cost that is open the short horizontal line to the left and the close price – to the right. The benefit that is major this graphical presentation is the indicator not just of prices, but also associated with the trading range for the given time framework. Somewhat comparable to candlestick maps, see below.

Next Page

Technicle Analysis For Forex Traders - Academy Of Financial Trading (Part 1)

What's analysis that is technical how exactly does it work?

Technical analysis is a method for forecasting price that is future based on studying previous and/or current cost behavior. These assistance that is skill anticipate what costs tend to accomplish in the future, using a variety of cost charts.

Technical analysis enables cost analysis on any period of time (intra-day, day, week, month etc) and, precisely in reverse to analysis that is fundamental doesn't try to find causes and reasons which give an explanation for price behavior, using just the shape of price charts to determine future cost motions.

Pretty much every market investor apply of technical analysis to varying degrees, even if that is just glancing at the cost chart. Nevertheless the majority of traders could keep an eye on technical indicators feedback that is supplying therefore the market's mood such as moving average, trading volume, energy, volatility and so forth.

Maps offer traders with an illustration as to whether the price that is present fair according to the price history of a specific market, or if the cost has reach a historical cyclical top, or maybe a perennially volatile and stubborn sideways market mover or numerous, many other situations. Based regarding the sophistication associated with technician and their tools, charts also can offer much more interpretation that is advanced of areas.

Limitations of and problems with technical analysis:

A little like economics while its proponents praise it the theory's objective approach, newcomers to technical analysis ought to be warned that technical analysis similar to an art form than a technology.

Technical analysis is really as much open to interpretation as fundamental analysis, despite the supposedly hard and fast rules. You could get two chartists to analyse exactly the same chart that is complicated each could see a different patterns. Like fundamental analysis, interpretation can consider heavily on analysis, with a analyst that is bullish more positive signs where a technical bear might read the runes their very own way.

As the joke goes: technical analysis may be the art of drawing a crooked line from an unproved assumption to a summary that is foregone.

Some technical signals and habits never constantly work while the theories can offer numerous helpful indicators into the right hands. Some rules are not steadfast and may be topic to other factors such as amount and momentum, while a thing that works for starters stock may not work with another and each security will have its idiosyncrasies which can be very own.

Technicians are also sometimes criticized because by enough time a trend is identified, part that is significant of cost move has currently taken place. And equally these analysts are also occasionally branded as fence-sitters, as even when they make a call that is bearish is usually another indicator or some level that will qualify their viewpoint.

BUT– do not let this put necessarily you off. Traders and investors who utilize technical analysis state they are helped because of it make cash. Think of it as an creative talent, flexible and at the mercy of interpretation, which each investor can make use of as suits his or her style. The benefits can be significant.

The four fundamental rules of technical analysis:

Technical analysis relies in component through the financial some ideas of Dow Theory developed by Wall Street Journal editor Charles Dow's analysis of market behavior prior to the turn that is previous of century and re-defined by analyst SA Nelson and monetary authors Robert Rhea, William Hamilton and E George Schaefer. Also today, more than a hundred years later on, traders who employ technical analysis (sometimes called technicians or chartists) still derive weighty trading choices based on the principles and the different parts of this system, while other article writers like Richard Schabacker are hugely crucial in developing analysis that is technical pattern analysis.

The concept is built upon four assumptions being fundamental that prices incorporate all information available on the market. 2nd, that price motions are perhaps not random. Third, that history repeats itself. And lastly that "What" is more crucial than "Why" – which fundamentally distances this concept at the contrary that is polar of analysis. Let's look deeper into these ideas that are main.

1: Prices incorporate all information available on the market:

Based on technical analysis or professionals themselves, the present cost of a share or a money incorporates all required information, such as: economic forecasts, expected increases or cuts in rates of interest, anticipated publication of economic data, traders' hopes and fears and thus on – all the known knowns, as Donald Rumsfeld might state as they like to phone. All this information, it consequently represents a real value – which supposedly provides a great foundation for market analysis because the cost discounts. Another way of saying this will be that the stock market discounts all news that is available.

2: Price movement is not random:

As a guideline analysis that is technical that prices move around in trends. But, the most of specialists also recognise that we now have periods when prices don't trend. If prices were always random, it will be enormously tricky to earn profits making use of analysis that is technical. As futures trader Jack Schwager place it: "markets may witness extended durations of random fluctuation, interspersed with shorter durations of non-random behavior. The target of the chartist is to recognize those periods (in other words. major trends)."

Click right through to see some types of live charts of sideways trends here – or channels or no trends, or this pattern is usually called.

3: History repeats itself:

The administrative centre markets often displays herd behaviour you may possibly expect from big groups of sheep and is hence usually called the 'herd'. The market persistently follows particular emotional patterns again and once again as a large mass of likewise inspired operators. By vigilantly examining price maps, traders will notice investor behaviour under particular conditions is usually duplicated, allowing you to behave with a point of self-confidence if the thing is the same specific conditions coming around the full time that is next.

4: What' is more important than 'why':

Traders whom employ technical analysis are principally interested in two concerns: 'What could be the price that is current' and 'What is the cost motion history?'.

So, in the event that cost motion had been up, this is because easy from the analyst that is technical viewpoint: there are more buyers than sellers – they're not worried at exactly about why the price relocated that means. By emphasizing the market price and only the cost, technicians do away with all the element that is speculative of analysis and just why the price techniques as it will. For chartists, the reasons which are fundamental for price movements are too often extremely questionable so the 'why' component of the equation is simply too vague and so they chop it down. They reason why the value associated with asset is the cost paid it to get up or down because of it– rather than the causes which caused.

NEXT PAGE

Technical analysis is a method for forecasting price that is future based on studying previous and/or current cost behavior. These assistance that is skill anticipate what costs tend to accomplish in the future, using a variety of cost charts.

Technical analysis enables cost analysis on any period of time (intra-day, day, week, month etc) and, precisely in reverse to analysis that is fundamental doesn't try to find causes and reasons which give an explanation for price behavior, using just the shape of price charts to determine future cost motions.

Pretty much every market investor apply of technical analysis to varying degrees, even if that is just glancing at the cost chart. Nevertheless the majority of traders could keep an eye on technical indicators feedback that is supplying therefore the market's mood such as moving average, trading volume, energy, volatility and so forth.

Maps offer traders with an illustration as to whether the price that is present fair according to the price history of a specific market, or if the cost has reach a historical cyclical top, or maybe a perennially volatile and stubborn sideways market mover or numerous, many other situations. Based regarding the sophistication associated with technician and their tools, charts also can offer much more interpretation that is advanced of areas.

Limitations of and problems with technical analysis:

A little like economics while its proponents praise it the theory's objective approach, newcomers to technical analysis ought to be warned that technical analysis similar to an art form than a technology.

Technical analysis is really as much open to interpretation as fundamental analysis, despite the supposedly hard and fast rules. You could get two chartists to analyse exactly the same chart that is complicated each could see a different patterns. Like fundamental analysis, interpretation can consider heavily on analysis, with a analyst that is bullish more positive signs where a technical bear might read the runes their very own way.

As the joke goes: technical analysis may be the art of drawing a crooked line from an unproved assumption to a summary that is foregone.

Some technical signals and habits never constantly work while the theories can offer numerous helpful indicators into the right hands. Some rules are not steadfast and may be topic to other factors such as amount and momentum, while a thing that works for starters stock may not work with another and each security will have its idiosyncrasies which can be very own.

Technicians are also sometimes criticized because by enough time a trend is identified, part that is significant of cost move has currently taken place. And equally these analysts are also occasionally branded as fence-sitters, as even when they make a call that is bearish is usually another indicator or some level that will qualify their viewpoint.

BUT– do not let this put necessarily you off. Traders and investors who utilize technical analysis state they are helped because of it make cash. Think of it as an creative talent, flexible and at the mercy of interpretation, which each investor can make use of as suits his or her style. The benefits can be significant.

The four fundamental rules of technical analysis:

Technical analysis relies in component through the financial some ideas of Dow Theory developed by Wall Street Journal editor Charles Dow's analysis of market behavior prior to the turn that is previous of century and re-defined by analyst SA Nelson and monetary authors Robert Rhea, William Hamilton and E George Schaefer. Also today, more than a hundred years later on, traders who employ technical analysis (sometimes called technicians or chartists) still derive weighty trading choices based on the principles and the different parts of this system, while other article writers like Richard Schabacker are hugely crucial in developing analysis that is technical pattern analysis.

The concept is built upon four assumptions being fundamental that prices incorporate all information available on the market. 2nd, that price motions are perhaps not random. Third, that history repeats itself. And lastly that "What" is more crucial than "Why" – which fundamentally distances this concept at the contrary that is polar of analysis. Let's look deeper into these ideas that are main.

1: Prices incorporate all information available on the market:

Based on technical analysis or professionals themselves, the present cost of a share or a money incorporates all required information, such as: economic forecasts, expected increases or cuts in rates of interest, anticipated publication of economic data, traders' hopes and fears and thus on – all the known knowns, as Donald Rumsfeld might state as they like to phone. All this information, it consequently represents a real value – which supposedly provides a great foundation for market analysis because the cost discounts. Another way of saying this will be that the stock market discounts all news that is available.

2: Price movement is not random:

As a guideline analysis that is technical that prices move around in trends. But, the most of specialists also recognise that we now have periods when prices don't trend. If prices were always random, it will be enormously tricky to earn profits making use of analysis that is technical. As futures trader Jack Schwager place it: "markets may witness extended durations of random fluctuation, interspersed with shorter durations of non-random behavior. The target of the chartist is to recognize those periods (in other words. major trends)."

Click right through to see some types of live charts of sideways trends here – or channels or no trends, or this pattern is usually called.

3: History repeats itself:

The administrative centre markets often displays herd behaviour you may possibly expect from big groups of sheep and is hence usually called the 'herd'. The market persistently follows particular emotional patterns again and once again as a large mass of likewise inspired operators. By vigilantly examining price maps, traders will notice investor behaviour under particular conditions is usually duplicated, allowing you to behave with a point of self-confidence if the thing is the same specific conditions coming around the full time that is next.

4: What' is more important than 'why':

Traders whom employ technical analysis are principally interested in two concerns: 'What could be the price that is current' and 'What is the cost motion history?'.

So, in the event that cost motion had been up, this is because easy from the analyst that is technical viewpoint: there are more buyers than sellers – they're not worried at exactly about why the price relocated that means. By emphasizing the market price and only the cost, technicians do away with all the element that is speculative of analysis and just why the price techniques as it will. For chartists, the reasons which are fundamental for price movements are too often extremely questionable so the 'why' component of the equation is simply too vague and so they chop it down. They reason why the value associated with asset is the cost paid it to get up or down because of it– rather than the causes which caused.

NEXT PAGE

Thursday, 5 February 2015

Technical Analysis Tutorial - Free Forex learning

There are two types of analysis in Forex market :

1. Technical Analysis

2. Fundamental Analysis

We are going to discuss "Technical Analysis" In this post:

we shall start from a market term called "Bull" and "Bear"

BULL AND BEAR MARKET:

BULL MARKET:

A market is once the market seems to be during a semipermanent climb. Bull markets tend to develop once the economy is powerful, the percent is low, and inflation is in restraint. The emotional and condition of investors additionally affects the market. for instance, if investors have religion that the upward trend available costs can continue, they're doubtless to shop for a lot of stocks. If there square measure a lot of consumers curious about shopping for shares at a given worth than there square measure sellers UN agency square measure willing to dispense with their shares at that worth, stock costs can still rise.

BEAR MARKET:

A securities industry describes a market that seems to be in an exceedingly semipermanent decline. Bear markets tend to develop once the economy enters a recession, state is high, and inflation is rising. Investors lose religion within the market as an entire, that successively decreases the demand for stocks. confine mind that a sustained securities industry are a few things that you just ought to expect to occur from time to time, and that, within the past, the exchange has up over it's declined.

Technical Analysis:

Technical analysis is that the framework within which forex traders study worth movement.The theory is that someone will scrutinize historical worth movements and confirm this commercialism conditions and potential worth movement.

The main proof for victimization technical analysis is that, on paper, all current market info is mirrored in worth. If worth reflects all the knowledge that's out there, then worth action is all one would really want to form a trade.

Now, have you ever ever detected the previous locution

History repeat itself !

Well, that’s essentially what technical analysis is all about! If a index number command as a key support or resistance within the past, traders can keep a watch out for it and base their trades around that historical index number.

Technical analysts explore for similar patterns that have fashioned within the past, and this type of trade concepts basic cognitive process that worth will act constant means that it did before.

1. Technical Analysis

2. Fundamental Analysis

We are going to discuss "Technical Analysis" In this post:

we shall start from a market term called "Bull" and "Bear"

BULL AND BEAR MARKET:

BULL MARKET:

A market is once the market seems to be during a semipermanent climb. Bull markets tend to develop once the economy is powerful, the percent is low, and inflation is in restraint. The emotional and condition of investors additionally affects the market. for instance, if investors have religion that the upward trend available costs can continue, they're doubtless to shop for a lot of stocks. If there square measure a lot of consumers curious about shopping for shares at a given worth than there square measure sellers UN agency square measure willing to dispense with their shares at that worth, stock costs can still rise.

BEAR MARKET:

A securities industry describes a market that seems to be in an exceedingly semipermanent decline. Bear markets tend to develop once the economy enters a recession, state is high, and inflation is rising. Investors lose religion within the market as an entire, that successively decreases the demand for stocks. confine mind that a sustained securities industry are a few things that you just ought to expect to occur from time to time, and that, within the past, the exchange has up over it's declined.

Technical Analysis:

Technical analysis is that the framework within which forex traders study worth movement.The theory is that someone will scrutinize historical worth movements and confirm this commercialism conditions and potential worth movement.

The main proof for victimization technical analysis is that, on paper, all current market info is mirrored in worth. If worth reflects all the knowledge that's out there, then worth action is all one would really want to form a trade.

Now, have you ever ever detected the previous locution

History repeat itself !

Well, that’s essentially what technical analysis is all about! If a index number command as a key support or resistance within the past, traders can keep a watch out for it and base their trades around that historical index number.

Technical analysts explore for similar patterns that have fashioned within the past, and this type of trade concepts basic cognitive process that worth will act constant means that it did before.

Subscribe to:

Comments (Atom)