vwap complete explained in stock market

According to VWAP definition or volume weighted average price, as the name describes shows the average true price of the stock. The VWAP calculations identifies the true price by taking into account the volume of transactions that take place at a specific price.

The VWAP is useful as some traders believe that the average price based on the closing value does not represent an accurate picture of the security being analyzed.

As a result, the volume weighted average price was discovered which helps to find the true price based on the number of transactions that take place. This is in a way, a different view of the markets. But at the same time, the volume weighted average price is seen close to the real closing price of the security.

Using volume weighted average price, traders are able to ask questions such as whether the price of the stock close at a high or a low with high or low volume or if the volume was representative of the price of the stock or the security when it hit a new high or a low.

The answer to these questions can only be found with the volume weighted average price. The VWAP bands is one of the most common way to look at price by day traders. Volume weighted average price is widely used in day trading of stocks.

This has a significant advantage because securities that are traded at an exchange also show the real volume of the transactions. This includes futures and stocks. With the forex markets however, due to the over-the-counter nature of the trades, it is difficult to get an accurate view of the real volume.

Despite this short coming, many traders use the VWAP fully knowing that it does not accurately represent the true volume of the currency pair on which the VWAP is applied to.

One of the reasons for this because traders believe that the VWAP sbi is a better indicator compared to the regular moving averages. The regular moving averages as you know are based off the closing prices. Therefore, they represent the closing price of the security.

The VWAP on the other hand continuously plots the average price at the weighted volume. Sometimes, traders tend to use the average moving VWAP as well in conjunction with the VWAP indicator. In this instance, the VWAP moving average works in the same way as a regular moving average would.

The only difference is that instead of plotting the average price based on the close, the moving VWAP plots the average VWAP as price progresses. However, in this article, we will talk about the volume weighted average price indicator that is developed for the currency markets.

You can of course apply it to other securities too. But bear in mind that the results will still be same. For example, you might think that you could apply the VWAP to the stocks that you see on your MT4 trading platform.

The fact is that the stocks that are available for you trade are mostly OTC derivatives such as the contract for differences. Therefore, this still defeats the purpose. The best example would be to use the volume weighted average price on a MT5 trading platform that allows you to trade futures.

Here, the indicator can work its magic.

The VWAP formula in stock is primarily suited for the day traders. These would be, short term traders who trade for a few minutes to a few hours. The VWPA doesn’t technically work on longer term charts.

The VWAP is often used with trading a large number of trades during a given session. It is fast moving and therefore requires some practice before you can get familiar with trading with the VWAP.

Before we go into the details of how to use the volume weighted moving average, let’s first look at what VWAP is and why traders prefer this compared to regular prices.

What is VWAP or volume weighted average price?

VWAP or volume weighted average price gives traders an idea of the average price that investors paid for a security. The VWAP is taken into account over the course of a trading session.

In a way,

the volume weighted average price gives traders an idea of how the large money or the wider markets are positioned.

For example, if you see that there has been a lot of transactions taking place at a particular price level, you can expect that there is a lot of buying or selling interest at that price. The VWAP in a way can therefore show price levels that could potentially act as support or resistance.

VWAP has also become widely popular in the trading community because they are most important with algorithmic and high frequency trading. These high level automated trading systems make use of the VWAP in order to scale into or scale out of positions.

A trading algorithm can also automatically break down the large chunks of trade into smaller positions or blocks and use the VWAP. This allows large hedge funds and financial institutions to minimize the risk of their trades influencing the markets and to avoid front running of traders.

As you can see, VWAP is a more technical and an advanced way of trading compared to regular indicator based methods. As a result of this, it has caught the fancy of day traders who believe that their trading strategy can be improved based on the volume weighted average price. There are a number of free VWAP indicators available. Among the many, we take a look at this one particular free VWAP indicator that you can use on the MT4 trading platform.

How to use the free VWAP indicator?

Traders use the VWAP in many different ways. One of the common approaches is that when price of a security is trading below the VWAP, that security is said to be trading at a discount. Likewise, when the price of a security is trading above the VWAP, that price of the security is said to be trading at a premium.

At regular intervals, price tends to revert to the VWAP.

The VWAP is based on a calculation of the prices. It is as follows.

For the selected period, the typical price is taken. Typical price is the average of the High, Low and Close. Every session or period is represented by one bar or a candlestick. Traders can use or set the period to anything of their choice. From five minutes to 15 minutes or more (below daily time frames).

The typical price is now multiplied by the volume. Now this value alongside the volume for that session is calculated. These are known as cumulative volumes and cumulative typical price times volume (TP x V).

The final calculation is based on dividing the cumulative TP x V by the cumulative volume to give you the volume weighted average price for that period. When the VWAP is calculated over every period.

These values are now placed on the price chart (similar to how a moving average is displayed). VWAP falls into the category of volume analysis and there are many other tools besides just the VWAP indicator.

Therefore, traders should use this indicator only if they are completely sure of how this indicator works and what it means. Do not expect this indicator to generate buy and sell signals blindly.

VWAP was originally intended for algorithmic trading and for analyzing the orders in the markets. However, it is not surprising that this indicator has also found its way into being used as a technical trading indicator.

Installing the free VWAP indicator on MT4

The VWAP indicator can be copied onto the MQL folder and in the indicator folder. From here on, you can open your MT4 trading terminal and then open the navigator window. Right click on the indicators and refresh so as to allow your MT4 trading platform to pick up the indicator.

Once you see the VWAP indicator on the navigator window, you can then drag and drop this indicator onto the chart of your choice. You will now be presented with the configuration window.

The below picture shows how the configuration window looks like.

vwap example

VWAP indicator MT4 Configuration

As you can see, the settings are fairly simple. You can only set the period and the shift. It is not recommended to use the shift as that is not how the VWAP indicator is supposed to work. You can of course play around with the period values and change them to your choice.

Once the indicator is configured, you can click ok and you will see the VWAP showing as below on your price chart.

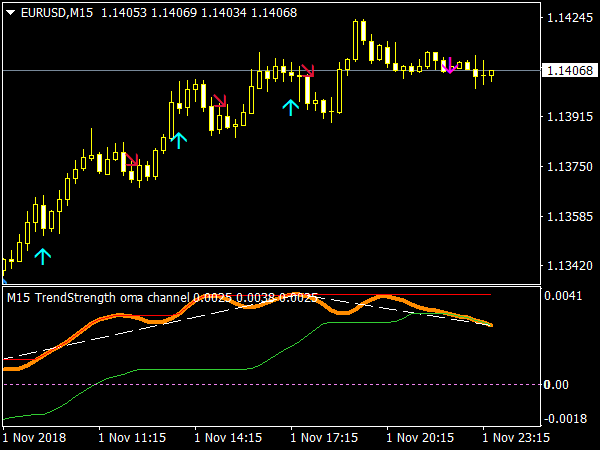

VWAP indicator MT4

You can see that the VWAP indicator basically looks like a moving average. That is all there is to it. However, you will see that this VWAP is a bit different because price trades very close to the VWAP zerodha at all times.

Every time price jumps above or below the VWAP, traders tend to look at these as trading signals. Therefore, we can conclude the VWAP acts as a mean reversion tool as price tends to gravitate back to the VWAP values.

But as mentioned in the earlier parts of this article, using ninjatrader VWAP in a market where there is no measurable way to gauge the volume can render the indicator pointless. But some traders argue that thinkorswim VWAP is still a good way to understand the true price in the markets.

The midas VWAP is ideally used for order execution and analysis. It is mostly used with algorithms because they can quickly ascertain whether price is trading above or below the VWAP in order to get a good fill on their executions.

The 30 day VWAP is also widely used in volume distribution analysis. This method gives an accurate representation of volume distribution and can generate returns for the algos. Because large volume trades can move the markets significantly, the VWAP is often used as a way to gauge where there is more liquidity in the markets in order to mask the large institutional traders.

In the world of retail forex trading, of course, traders use the VWAP simply as a way to sell when price is above the VWAP or to buy when price is below the VWAP. However, looking at the example chart shown previously, you will see that VWAP constantly changes.

Therefore, opening and closing the trades simply because they are too high or too low from the VWAP can lead to a lot of losses if not applied correctly.

Free VWAP indicator – Conclusion

The Volume weighted average price indicator is an exclusive tool for day traders. It does not show on daily charts or anything beyond the daily time frame. Although it requires a lot of development to make an effective use of the VWAP, traders have adapted to simpler ways of trading with the free VWAP indicator.

The VWAP is widely used as a measure of trade fills. Because volume is an important aspect that brings liquidity to the markets, VWAP is used as a tool to measure this liquidity. Typically, when your order is filled above the VWAP, then it is considered to be non-optimal if you were placing a long order.

Similarly, if your order was filled below the VWAP if you are taking a short position, that too becomes a non-optimal fill. As a result, you will be able to gauge how good your trades are being filled based on the VWAP.

The indicator by all means is no holy grail and traders should realize this.

Simply using the VWAP indicator will not automatically improve your trading results. You will still have to make use of your tried and tested trading systems alongside the VWAP indicator.

Those who are into development of automated trading solutions will find that the VWAP can be put to good use especially in terms of the entry and target price levels. VWAP is commonly used with different trading methods such as analyzing the order book or volume profile.

These methods require an advanced knowledge of the market microstructure and how volume and price works together in order to truly take advantage of the tools such as the volume weighted average price indicator.

Download vwap bands indicator for mt4: