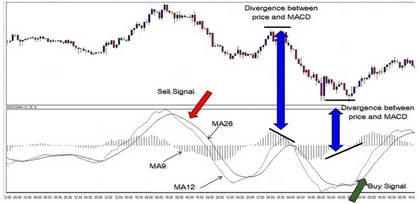

– Moving Average Convergence-Divergence that is (MACD) is an indicator also predicated on going averages. It's composed of two lines: the very first (bold) line (see chart from Sunbird FX below) is certainly the distinction between two averages which are moving. The MACD is just actually effective in a market showing a trend, and ineffective in an industry that is sideways.

Whenever the MACD lies higher than its 9-day exponential average that is moving technical analysts will consider energy to be bullish, or regarding the up. As soon as the MACD line breaks the sign line upwards, this comprises a confident sign, plus it shows a hold in the currency while it remains above the oscillator line. Once the sign is crossed by the MACD line line downwards, this represents an adverse or a sell signal.

A reversal from a poor value to a confident value is a buy signal, and the reverse - a sell signal with the MACD indicator.

STOCHASTICS:

The price tends to shut near its daily high, with strong buyer stress, while in downward trends, rates have a tendency to shut near their low, with strong vendor stress as a technical indicator, stochastics oscillators are based on the assumption that in an upward trend. Simply put, stochastics are employed to gauge whether a market is oversold or overbought. Above 80 in the oscillator is generally considered overbought and below 20 is known as oversold.

Stochastics oscillators are employed consequently to get the general position for the cost that is near the low while the high.

In other words, when the stochastic is below the 20 line that is oversold the %K line crosses over the %D line, buy. And as soon as the Stochastic is over the 80 line that is overbought the %K line crosses underneath the %D line, sell.

Like other tools that are technical they aren't stand-alones and really should be considered to be another tool, in addition towards the many technical tools which we utilize.

NEXT PAGE

No comments:

Post a Comment