Trading with the trend is probably one of the best ways to trade the markets, whether be it forex, commodities or stocks. It allows traders to identify trade direction easier since price would usually flow in the direction of a strong trend rather than against it. Some trend traders would even go as far as saying that trading with the trend is the only way to trade. Although there are surely other ways to trade, it just shows how much better it is to trade with the trend.

But how do we trade with the trend? First, let us define a trend. Trending market conditions is when price would flow in one direction more often. If the market is in a bullish trending condition, then price would usually close higher than the previous period and swing highs would usually go higher. On the other hand, during a bearish trend, price lows would usually go lower.

Gator Vigor Forex Trading Strategy is a strategy that is based on the concept that price would usually keep flowing in one direction during a trending market condition. Traders would usually price closing higher on a bullish trend, and lower on a bearish trend.

R Gator Indicator

The Gator indicator is an integral part of a set of indicators developed by the legendary trader Bill Williams, which he uses in his trading system.

This indicator basically consists of three Smoothed Moving Averages (SMA). The first moving average, which represents the long-term trend, is called the Jaw. The mid-term indicator is called the Teeth. Lastly, the short-term indicator is called the Lips. This set of moving averages create a band which moves along with price action rather smoother compared to other moving averages. The band expands during a trending market condition and contracts when the trend starts to slow down. Bill Williams refers to this as the opening and closing of the gator’s mouth.

Price – EMAs Indicator

The Price – EMAs indicator is an oscillating indicator which attempts to predict market trend direction, momentum and strength using a set of Exponential Moving Averages (EMA).

This indicator makes use of three EMAs. However, rather than placing the EMAs on the price chart, it plots the difference between the close of price and the EMAs. Whenever the close of price is higher than the mean, the oscillator plot the lines above zero. On the other hand, when the close is lower than the mean, the oscillator plot the lines below zero. In a bullish trend, the lines tend to be plotted higher and higher, while in a bearish trend, the lines are plotted lower and lower. The lines also expand whenever the trend is strengthening and contract when the trend is weakening.

Relative Vigor Index

The Relative Vigor Index (RVI) is an oscillator which is based on the concept that price tends to close higher during a bullish trend and closes lower during a bearish trend. It then shadows the movements of price action based on a mathematical computation intended to be in phase with the cycles of the market.

Inspecting the behavior of the RVI closely, you would notice that it does follow price action quite closely, with some divergences every now and then. This makes the indicator useful for divergence trading. It is also an unbounded oscillator with a midline at zero. Price tends to keep above zero during a bullish trend and below zero during a bearish trend. Having the trigger at zero also makes it useful as a trend reversal indicator.

Trading Strategy

This strategy is a trend reversal strategy based on the crossing over of the moving average lines of the R Gator indicator.

However, instead of taking the trade signals at face value, the strategy makes use of the Price – EMAs indicator as an indicator of trend reversal and strength. Trades are taken only when the three lines of the Price – EMAs indicator have crossed the midline.

This strategy also makes use of the Relative Vigor Index as a confirmation that the market is indeed trending based on the close of the candles. Trades are filtered based on the location of the RVI’s lines in relation to its midline.

Indicators:

- r_Gator

- period: 10

- period_1: 16

- period_2: 26

- price-emas

- Relative Vigor Index

- Period: 24

Timeframe: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

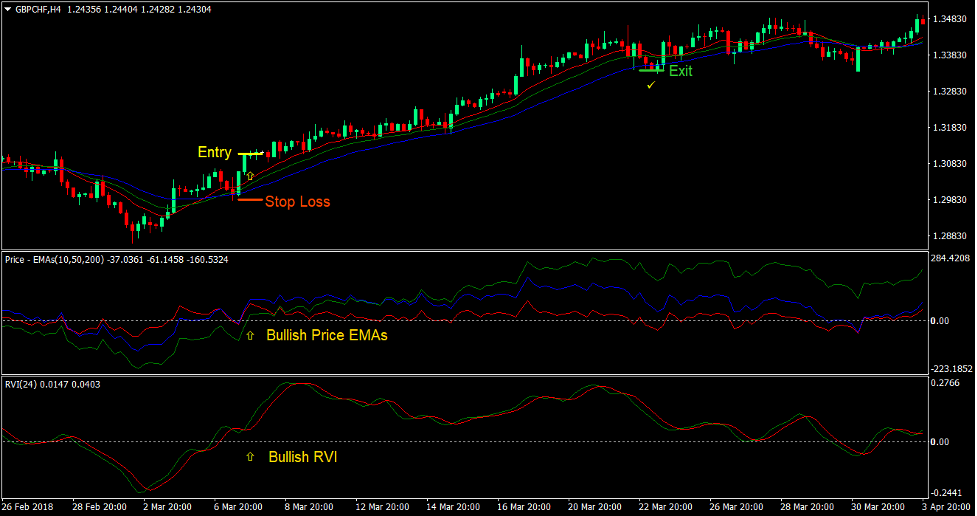

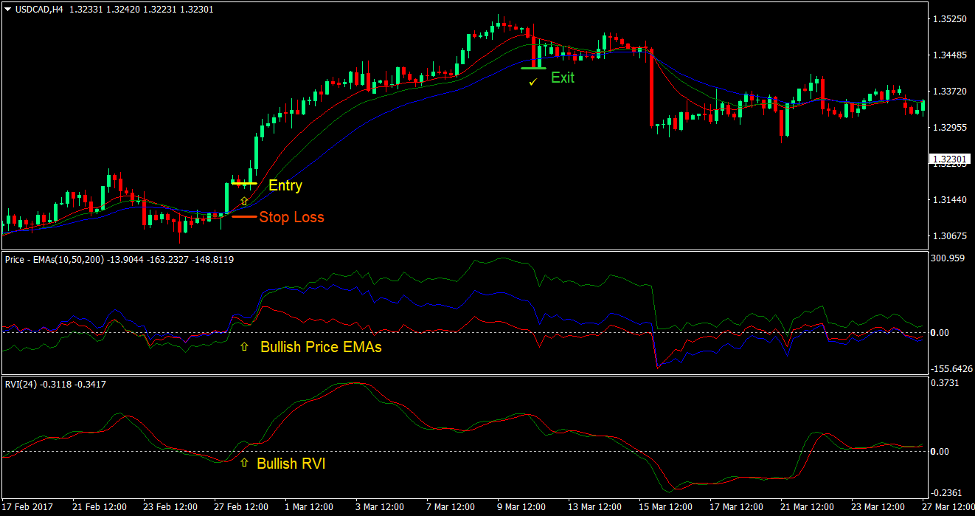

Buy Trade Setup

Entry

- The RVI lines should be above zero indicating a bullish trend

- The Price – EMAs lines should cross above zero indicating a bullish trend reversal

- The r_Gator indicator’s red line should cross above the green and blue lines indicating a bullish trend reversal

- Enter a buy order on the confluence of the above market conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Close the trade as soon as price closes below the blue line of the r_Gator indicator

Sell Trade Setup

Entry

- The RVI lines should be below zero indicating a bearish trend

- The Price – EMAs lines should cross below zero indicating a bearish trend reversal

- The r_Gator indicator’s red line should cross below the green and blue lines indicating a bearish trend reversal

- Enter a sell order on the confluence of the above market conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as price closes above the blue line of the r_Gator indicator

Conclusion

This strategy takes into consideration major aspects which are important a trend following strategy, trend direction, entry points based on trend reversals, and trend strength. By doing so, the strategy gets to have better chances at getting trades that would result in a trend. In fact, in most cases, the strategy would indicate trade setups that could yield reward-risk ratios of more than 2:1. However, not all cases are like this. There will be instances when the market would reverse too soon. For this reason, it is also very important to manage trades properly, moving stop losses to breakeven at the right time, and trailing stop losses at a good distance. This protects profits which could be lost whenever the market decides to reverse too soon.

Forex Trading Strategies Installation Instructions

Gator Vigor Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Gator Vigor Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

No comments:

Post a Comment